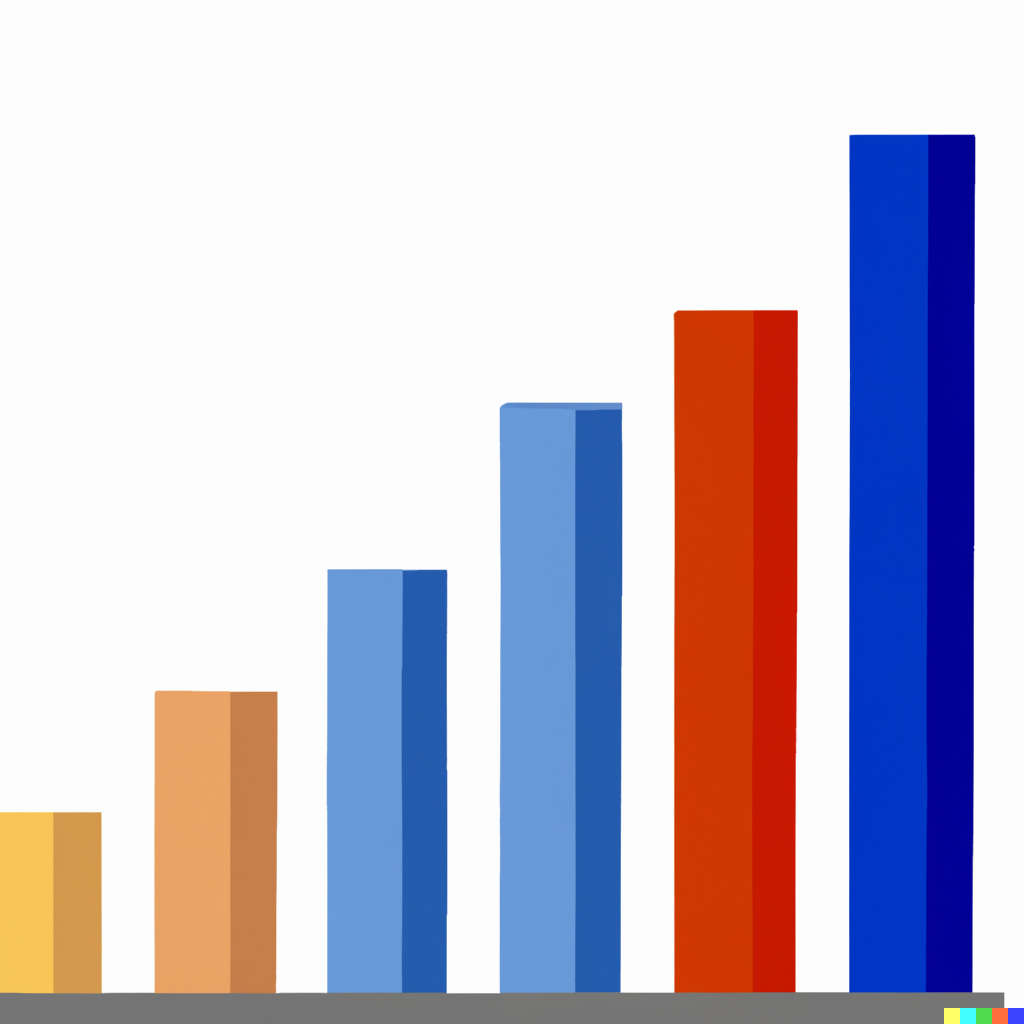

Purchasing transaction costs for private island and land investments in Anambas typically average 12-15% in total. The summary breakdown is.

- Transfer Tax (BPHTB) of 5.0% of the sale price.

The Acquisition of Land and Building Rights (Bea Perolehan Hak atas Tanah dan Bangunan, or BPHTB) is a tax imposed on the transfer of property ownership. The rate can vary between 1% and 5% of the property value, depending on the region. In Anambas this is 5%. - Notary Fee for title transfer of 1.5% to 2.5% (lower for higher land values).

Notary services are typically required to handle the legal aspects of the property transfer. The fees are usually based on the property value and the complexity of the transaction. - Land Certificate Fee, typically around 1% of the sale price.

These fees cover the issuance of a new land certificate in the buyer’s name. The cost is generally a percentage of the property value. - Legal Fees, which can vary based on the complexity of the transaction

These costs may include legal consultations, due diligence, and administrative fees associated with property transactions. The fees can vary depending on the complexity of the transaction and the services provided. Kepri Estates can acquire costs estimates for you from our affiliate legal panel if you wish to use their services for your investment. - Mortgage Fees

If you are financing the purchase through a mortgage, there may be fees associated with loan processing, appraisal, and mortgage registration.

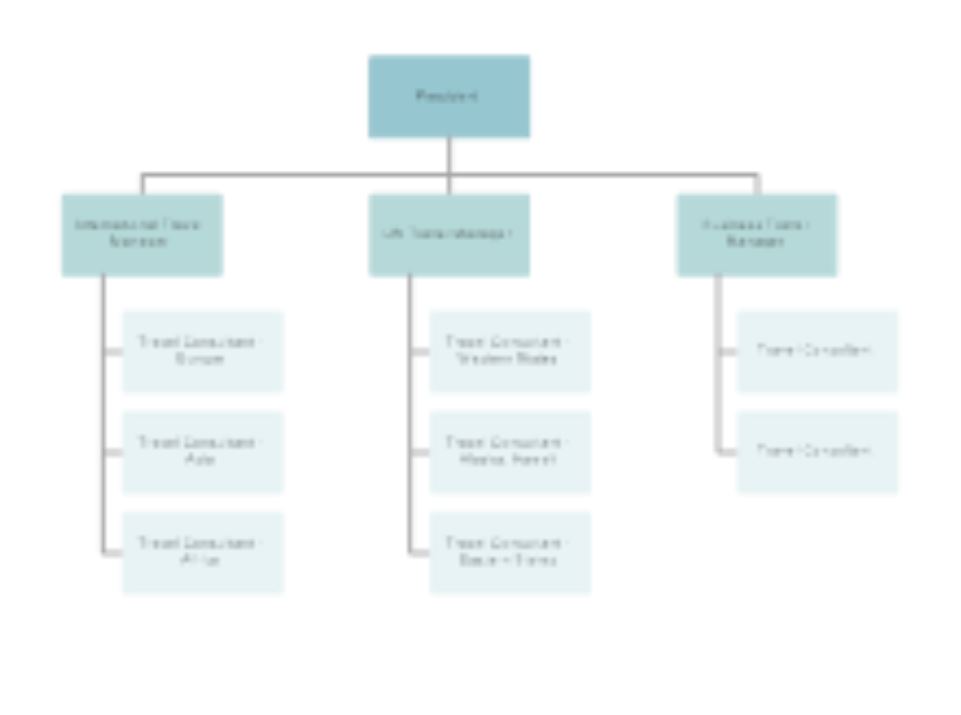

When purchasing land in the paradise islands of Anambas, it is recommended to get a cost estimate based on your overall development goals and “start with the end in mind”. Quite often the corporate structure of your initial purchase will influence the costs and outcomes in future if you wish to on sell part of the finished project, subdivide individual lots for others to purchase, or invest in a whole island and then subdivide and sell any portions for future growth etc. It is important to discuss your needs and goals from the investment and establish your corporate and legal structure to make the overall investment (and exit strategy if relevant) as seamless and cost effective as possible. If you need any further information on the above, please don’t hesitate to contact us directly at sales@kepriestates.com